The former Singapore regulator wants to transform Binance, the world’s largest cryptocurrency exchange, from controversial disruptor to mainstream financial institution—and prove crypto can solve what traditional banks cannot

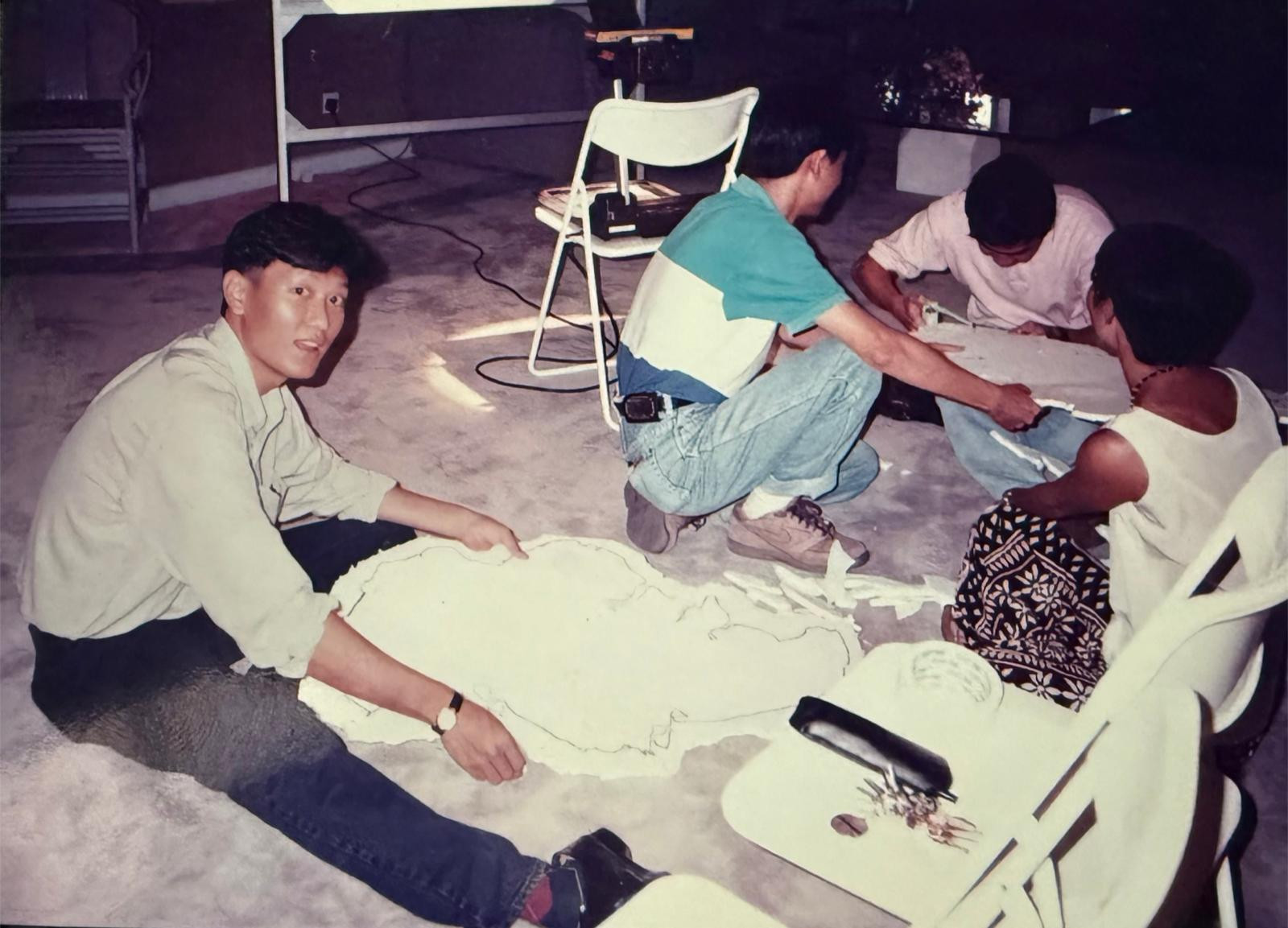

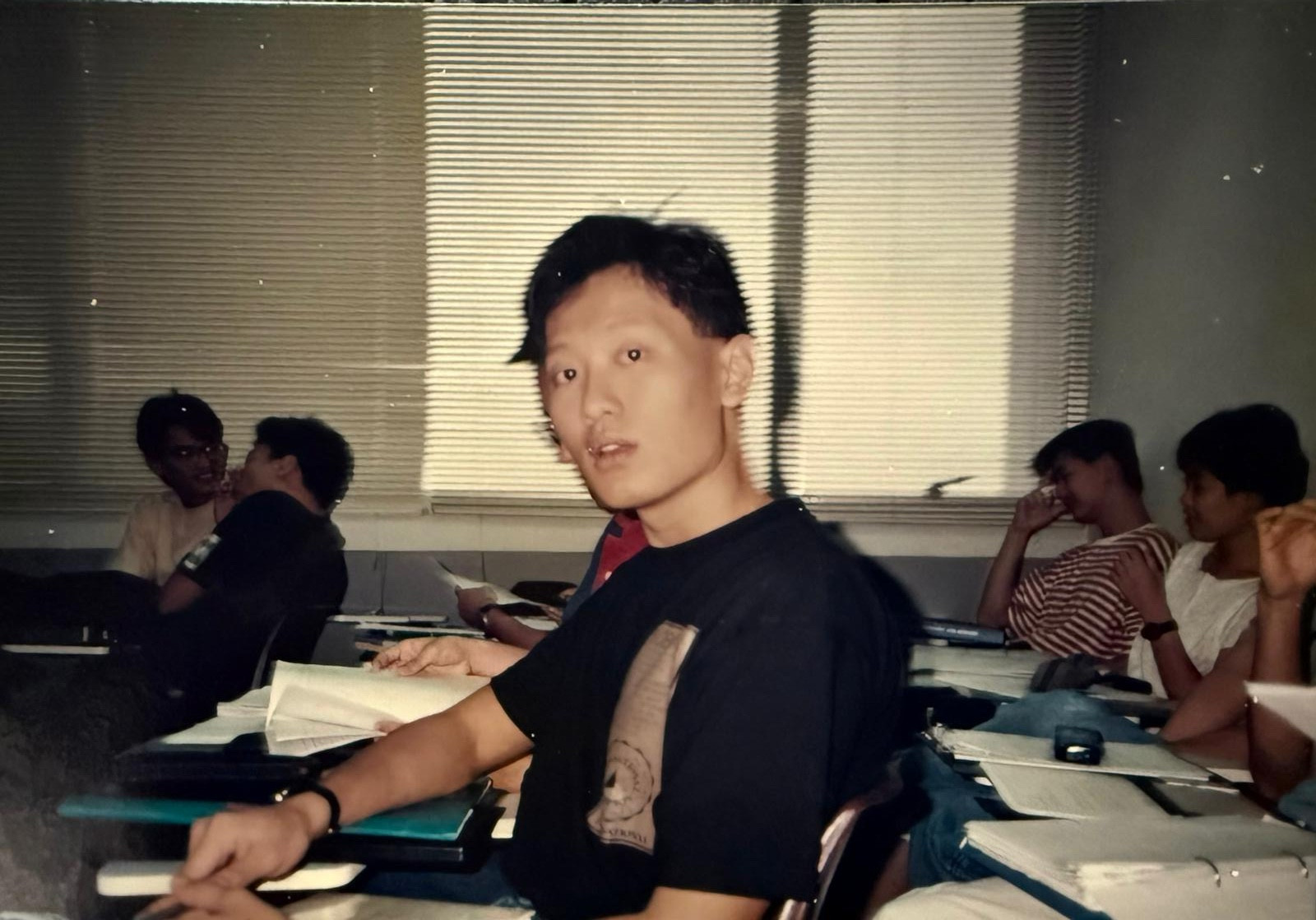

In November 2023, Binance, the world’s largest cryptocurrency exchange, announced the end of an era. Its co-founder and then CEO, Changpeng Zhao, who goes by CZ and is long synonymous with the company he built, stepped down. Succeeding him was Richard Teng, a former regulator from Singapore.

The move raised eyebrows, given the circumstances at the time: Binance had pleaded guilty to violating the US anti-money laundering and sanctions laws, agreeing to a landmark US$4.3 billion settlement with the Department of Justice. Zhao himself was sentenced to four months in prison, fined US$50 million, and barred from any operational or management role at the company. This past October, US President Donald Trump pardoned Zhao, lifting restrictions that had stopped him from running financial ventures.

Teng was no stranger to Binance. He joined the exchange in August 2021 as Binance Singapore’s CEO and, barely a month into the role, faced his first major hurdle when the Monetary Authority of Singapore (MAS), the nation’s central bank and integrated financial regulator, placed Binance on its Investor Alert List for offering payment services to Singapore residents without the necessary licence. The platform has since ceased its local operations.

But while Binance’s expansion in Singapore stalled, Teng’s ascent within the company gathered pace. He went on to oversee its operations across Europe, the Middle East, North Africa and Asia, before being appointed to the top job in 2023. His main goal upon taking the helm, he says, was to steer Binance “from a company [that was] often misunderstood into a mainstream [entity]”.

Read more: Bitcoin Asia 2025: industry experts on regulation, geopolitics and institutionalising digital assets

Drawing on his background as a former director at MAS and the chief regulatory officer at the Singapore Exchange, Teng positioned himself as a bridge between the authorities and the crypto industry. By then, the crypto world was already mired in controversy—its reputation badly tarnished by the 2022 collapse of FTX, once the world’s third‑largest cryptocurrency exchange, which left more than US$8 billion in customer funds unaccounted for.

In a sense, Teng’s appointment signalled Binance’s intent to lead by example and help restore credibility to an industry still struggling to earn public trust. “I’m helping regulators understand the value of the crypto industry,” he says, “and why things are set up differently.”

One of the misconceptions Teng is determined to dispel is that crypto facilitates money laundering. “People fail to realise that it’s a totally traceable technology,” he says, referring to how every crypto transaction is recorded on a public digital ledger distributed across a network of many computers—the blockchain—that cannot be altered by anyone. Fiat currency, by contrast, is issued and regulated by governments, with transactions processed through private, centralised banking systems that often lack transparency.

Read more: Stablecoins may be replacing your bank account soon